Opportunity Insights: Michigan Small Business COVID-19 Impacts

August 26, 2020Source: Raj Chetty, John Friedman, Nathaniel Hendren and Michael Stepner, Opportunity Insights

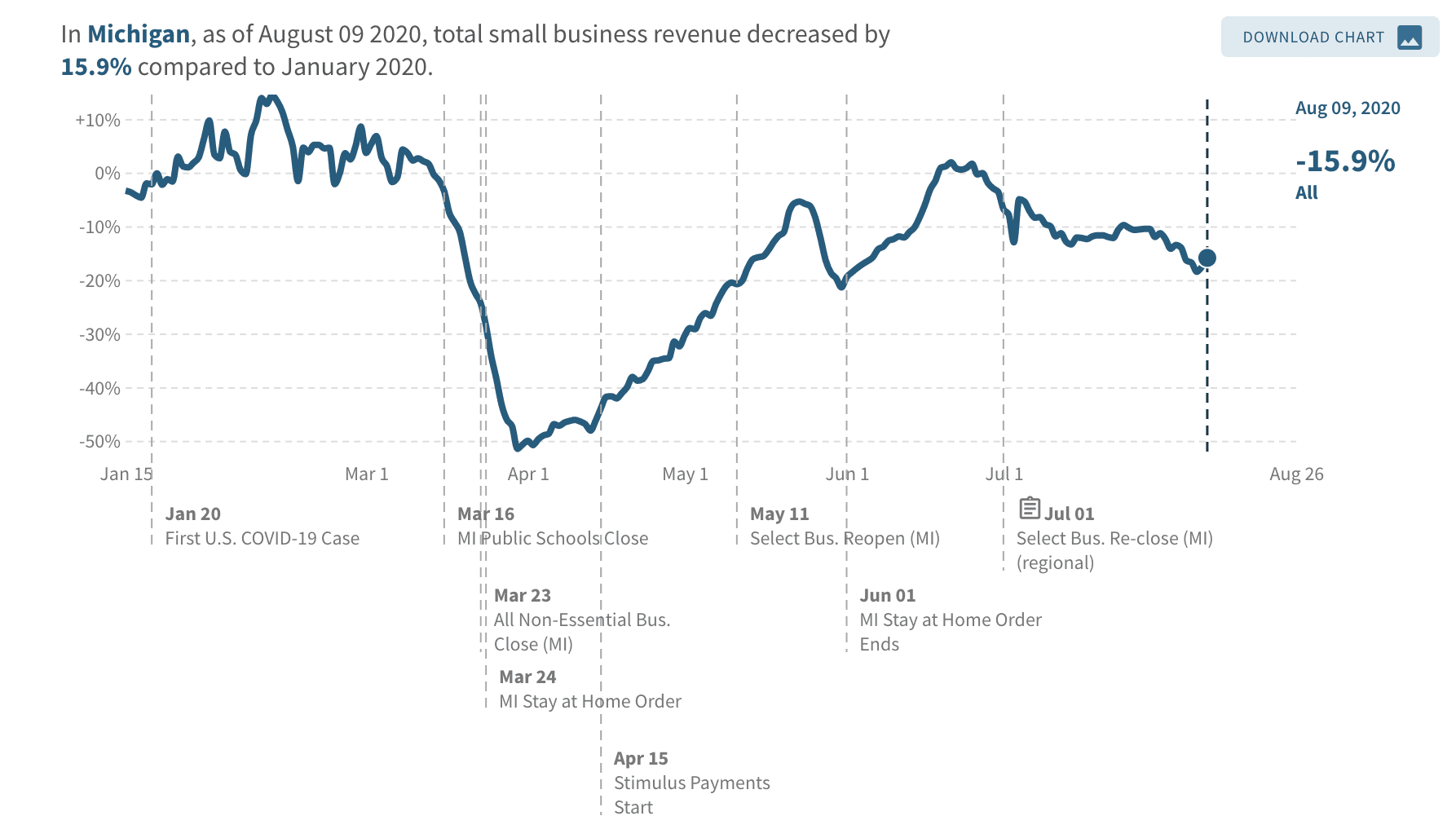

Small Businesses Revenue

In Michigan, as of August 9, 2020, total small business revenue decreased by 15.9% compared to January 2020. Looking back, shortly after the MI Stay at Home Order was declared on March 24, small business revenue decreased as low as 51% compared to January 2020. By comparison, the overall small business revenue for the U.S. is currently 21% below normal levels.

At the beginning of April around the time stimulus payments started, small business revenue gradually increased. Unfortunately, due to pandemic related shutdown in Michigan, like the reclosure of indoor bars on July 1, 2020, we can see a significant decline in small business revenue around this time.

Small businesses are defined by the Small Business Administration threshold. Size standards vary between industry but are generally based on the number of employees or the amount of annual receipts the business has. According to Opportunity Insight, they measured small business revenue as the sum of all credits (general purchases) minus debits (general returns).

Opportunity Insight analyzed data on small business transactions and revenues from Womply, a company that aggregates data from several credit card processors, to provide insights to clients. Womply covers the total revenues of small businesses. What sets the company apart is the location of the data Womply refers to. Traditionally, companies track the location of where cardholders live. Womply tracks the location of the business transaction. A larger share of the Womply revenue data come from industries that have a larger share of small businesses, such as food services, professional services, and other services.

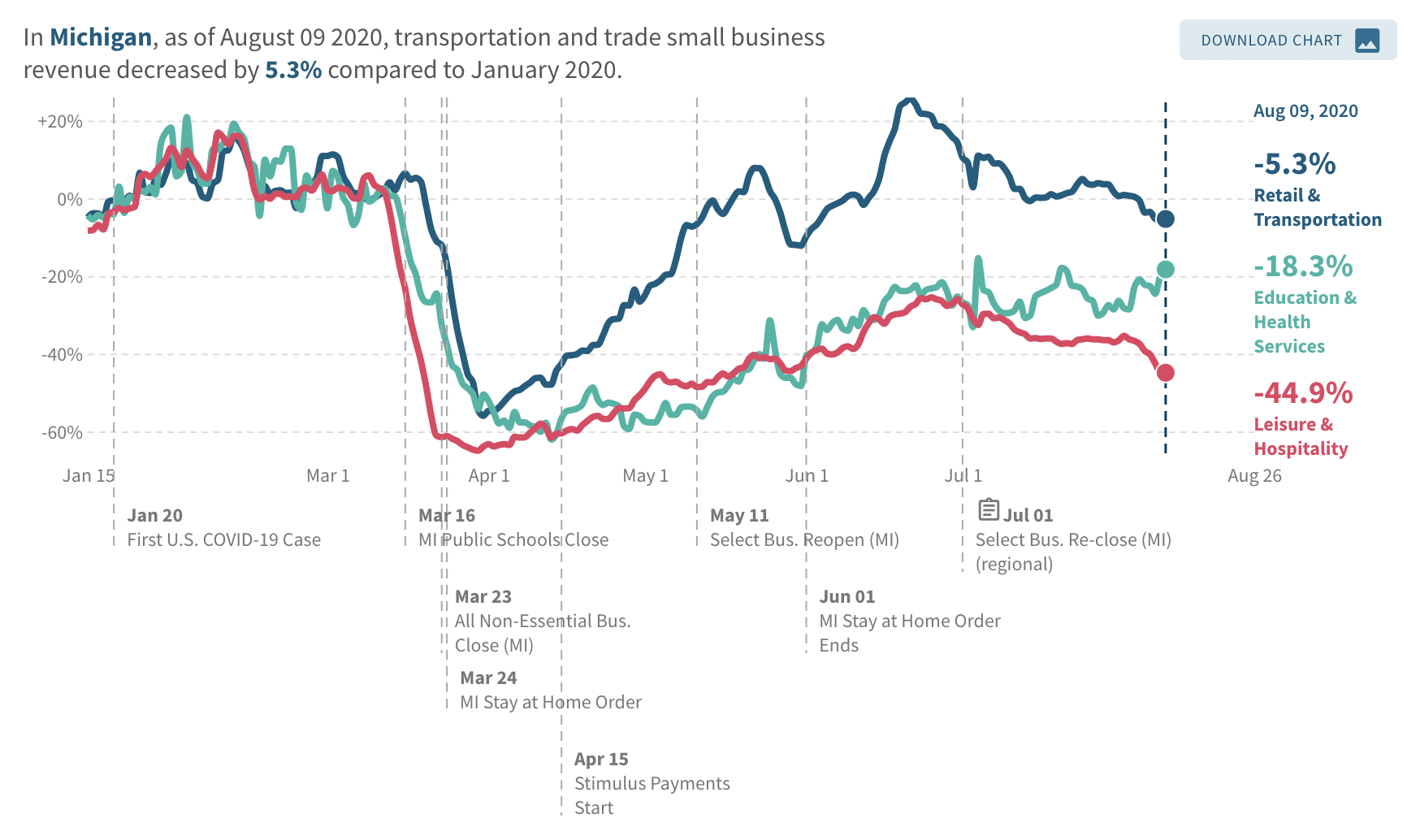

By Industry

When comparing small business revenue by industry, disparities are profoundly influenced by the current state of the pandemic. As of August 7, 2020, leisure and hospitality small business revenue decreased by 42.5%, compared to January 2020. This is most likely caused by the uncertainty of the virus and the enormous decline in travel. Education and health services small business revenue decreased by 24.6%, compared to January 2020, and retail and transportation small business revenue decreased by 5.3%, compared to January 2020.

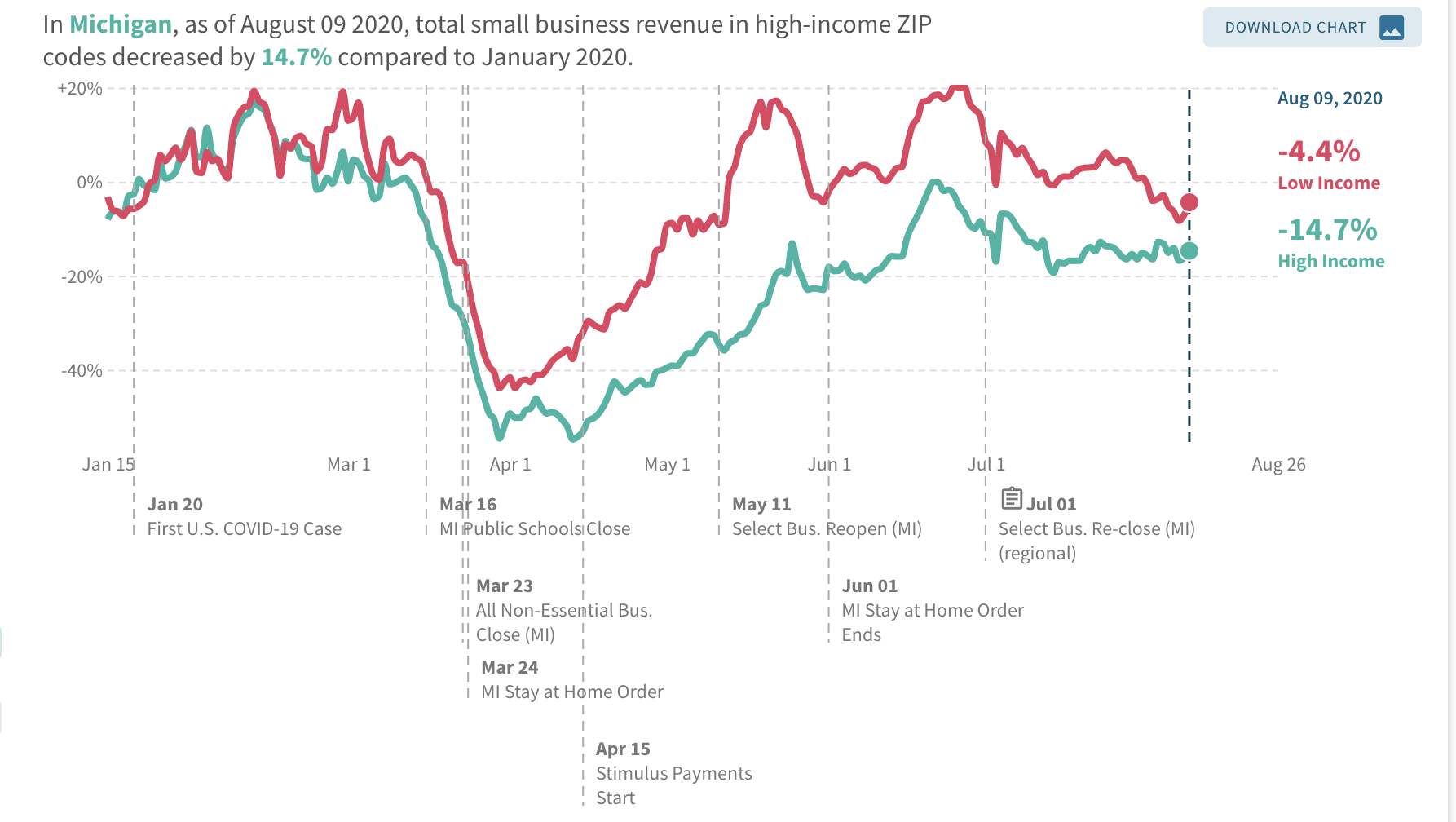

By Income

Examining how small business revenues changed in low-versus high-income ZIP codes shows that there is an overall revenue decline across all areas, but some more substantially impacted. In Michigan, as of August 7, 2020, total small business revenue high-income ZIP codes decreased by 14.7%, compared to January 2020. Small businesses in low-income ZIP codes experienced a revenue decline of 4.4%, compared to January 2020.

During the pandemic, according to OI, high-income people tend to spend more, as expected, including more on in-person services. The data collected showed that high-income households had a larger decline in spending during the pandemic, and this in return has disproportionately affected small businesses who sell goods or services in-person in high-income ZIP codes. These small businesses laid off most of their low-income employees, leading to a surge in unemployment claims in affluent areas. During the pandemic, total small business revenue in low-income ZIP codes decreased as low as 44%, and revenue in high-income ZIP codes decreased as low as 55%, compared to January 2020.

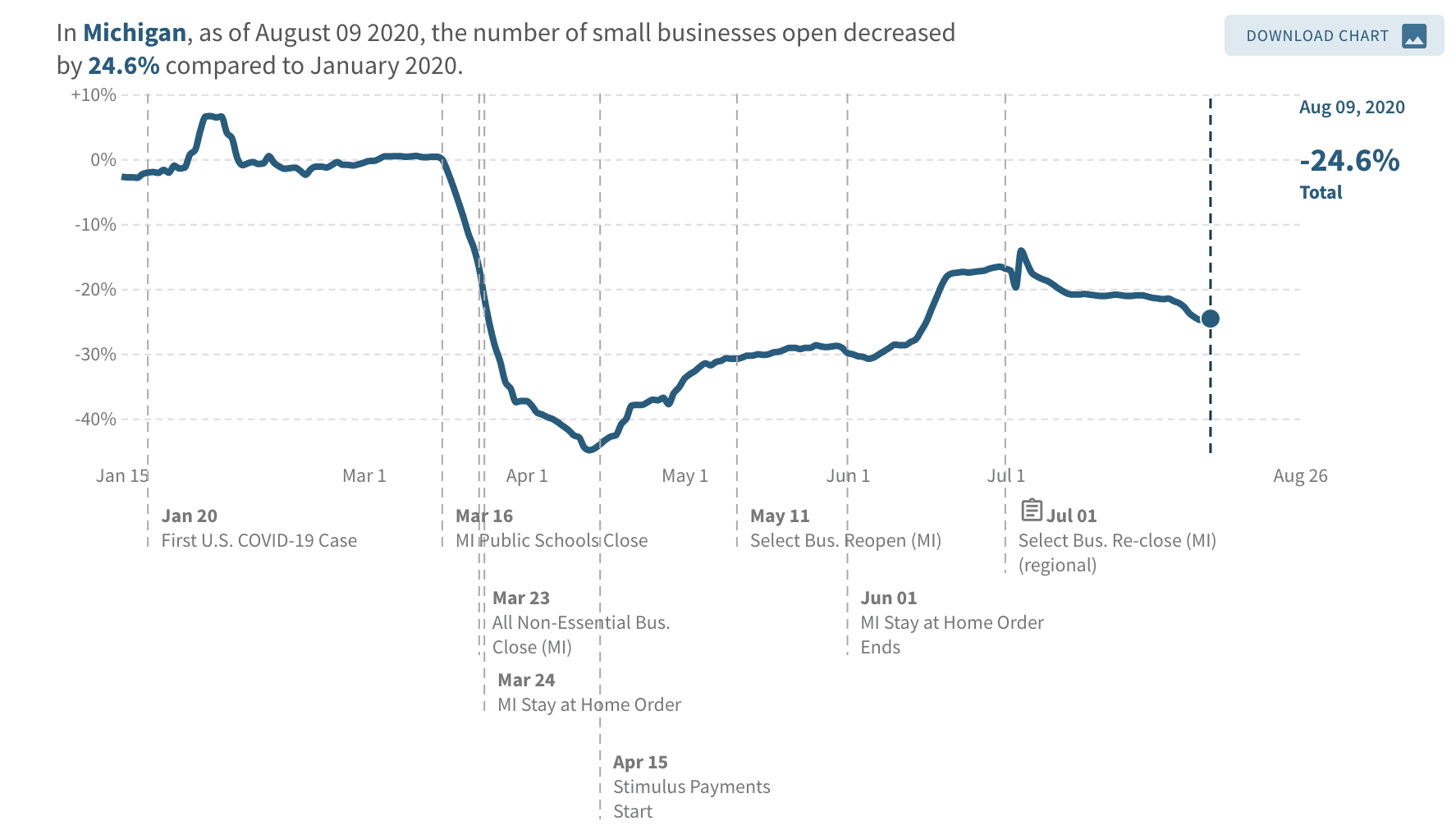

Small Businesses Open

In Michigan, as of August 09, 2020, the number of small businesses open decreased by 24.5%, compared to January 2020. During the beginning of the pandemic, small businesses open decreased as low as 45%, compared to January 2020. Throughout Michigan’s regions, various small businesses still remain closed due to the uncertainty of the virus, such as movie theaters and gyms.

A change in revenue for any sized business will influence their decision to remain open, how many employees they will keep on payroll, what wages to pay, and how many people to hire. According to OI, they defined small businesses being open if they had a transaction in the last three days. Excluding counties with a total average revenue of less than $250,000 during the pre-COVID-19 period (January 4-31).

The full interactive data set can be found at Opportunity Insights Economic Tracker.